- Wednesday November 17, 2021

What is Chart of Accounts COA: Definition, Examples & Structure

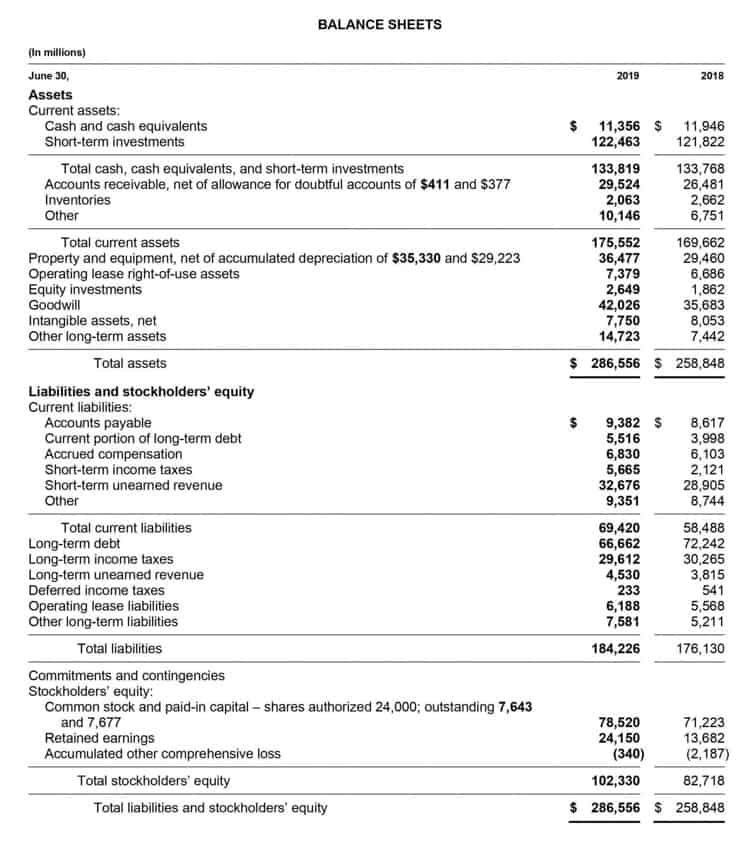

Traditionally, each account in the COA is numbered, and accountants can quickly identify its type by the first digit. For example, asset accounts for larger businesses are generally numbered chart of account numbers example 1000 to 1999 (or 100 to 199), and liabilities are generally numbered 2000 to 2999 (or 200 to 299). Small businesses with fewer than 250 accounts might have a different numbering system.

How to set up the chart of accounts

This coding system is crucial because a COA can display a multitude of line items for each transaction in every primary account. Liability accounts provide a list of categories for all the debts that the business owes its creditors. Typically, liability accounts will include the word “payable” in their name and may include accounts payable, invoices payable, salaries payable, interest payable, etc. But the final structure and look will depend on the type of business and its size. The chart of accounts streamlines various asset accounts by organizing them into line items so that you can track multiple components easily. QuickBooks Online automatically sets up a chart of accounts for you based on your business entity with the option to customise it as needed.

Example: Standard Chart of Accounts List

The account number may be found through the bank’s mobile app or on checks. If you use the bank’s mobile app to see your bank account number, select the bank account and click on “Show More Details.” The account number is located in the bank’s mobile app under the “Details” section. If you select “Account Overview” and the “Information and Services” tab you’ll be able to find the account number.

Why is the chart of accounts important?

This includes adding accounts specific to your industry or operational needs. Ensure that the numbering leaves room for additional accounts to be added as the business grows. Under each main category, there can be several sub-accounts to provide more detailed tracking. By the end of this blog, you’ll learn what a COA is, and how to set one up effectively.

- Now, according to the standard definition of a COA, it should focus on the many different accounts tying into your company’s general ledger.

- These standards provide guidelines for financial reporting, including the structure of the COA.

- These are the types of gains – as well as interest income, assuming you’re not a bank – that fall within this COA category, the ones you generate outside of your typical operations.

- Nevertheless, the exact structure of the chart of accounts is the reflection on the individual needs of each entity.

- All of those financial transactions generating operating revenue for your company fall into the P&L (income statement) category.

In the bigger picture, it also makes it difficult to accurately gauge your organization’s financial health. For example, additional information like company and cost center lists flesh out simple transactional data, providing more nuanced insights that your leadership will undoubtedly benefit from. We’ll go into greater detail in a bit but, for the time being, just remember that you have a large degree of flexibility when it comes to building your COA and tailoring it to your specific needs. A record in the general ledger that is used to collect and store similar information. For example, a company will have a Cash account in which every transaction involving cash is recorded.

Accounts Payable

With online accounting software, you can organize and track your balance sheet accounts. No matter if you’re an entrepreneur starting a business or an owner looking to streamline your practices, accounting software can help you get the job done. As your business grows, so will your need for accurate, fast, and legible reporting.

Account categories

Within each category, there are specific accounts that represent different types of transactions, so there are always a number of subaccounts within each account. It’s also worth saying that depending on the idustry and a business’s structure, more accounts can form the COA. In the United States businessesand organizations widely use a standardized chart of accounts. This standardization is particularly relevant when dealing with transactions such as the IRS Treas 310 Tax Ref, as it ensures that all financial activities are categorized correctly for tax purposes and compliance. The chart of accounts (COA) is a list of accounts a company uses to record its financial transactions.

How to Set Up a Chart of Accounts?

While Pacioli’s work laid the foundation for modern accounting, a standardized chart of accounts had yet to emerge. A chart of accounts is a vital financial tool that organizes numerous financial transactions in a manner that is easy to access. Because transactions are displayed as line items, they can be quickly found and assessed. Furthermore, big companies can have thousands of line items so a chart of accounts allows them to easily be broken down into different hierarchies and categories. A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger.

What Is the Use of a Chart of Accounts?

- For example, asset accounts for larger businesses are generally numbered 1000 to 1999 (or 100 to 199), and liabilities are generally numbered 2000 to 2999 (or 200 to 299).

- The accounts in the income statement comprise revenues and expenses, and these accounts are also broken down further into sub-categories.

- Equity is listed alongside liabilities, representing the shareholders’ stake in the company’s assets.

- Expenses are subtracted from revenue to calculate net income – the company’s profit or loss in the period in question.

Without a chart of accounts, it’s impossible to know where your business’s money is. The chart of accounts is like a map of your business and its various financial parts. For example, bank fees and rent expenses might be account names you use. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have. Your chart of accounts is a living document for your business and because of that, accounts will inevitably need to be added or removed over time.